A Little Known Secret for Selling to Enterprises: DEF 14A

Why this SEC Form can help you land the whale

As a sales leader, I am always looking for new and insightful ways to help improve our portfolio companies’ sales team’s strategies. Recently on Databook, I came across a document that is pure GOLD for any salesperson who is whale hunting (aka selling to the enterprise).

It’s called a DEF 14A. To get technical, Form DEF 14A is a filing with the SEC that must be filed by or on behalf of a registrant when a shareholder vote is required. The form provides the information necessary for all parties to make an informed vote, but as you might be guessing by now, relative to sales, this form is pure GOLD for understanding the company you are attempting to sell to on a much deeper level. The insights you can find far surpass what you might dig up on their website or news media.

A DEF14a typically includes:

- Background information about the company’s nominated directors including relevant history in the company or industry, positions on other corporate boards, and potential conflicts in interest.

- Board compensation.

- Executive compensation, including salary, bonus, non-equity compensation, stock awards, options, and deferred compensation. Also, information is included about perks such as personal use of company aircraft, travel, and tax gross-ups. Many companies will also include predetermined payout packages for if an executive leaves the company.

Now, why should you care about this?

- It’s the M in MEDPICC. Use this form to look at compensation metrics (M)

- Use this form to better understand what the management team really cares about.

- Use this form to understand what the targets were, what the performance was and whether the exec(s) has pain and urgency this year.

- Use this form to understand “who’s who” on the leadership team, and who has power.

- Use this form to understand how much the company is really growing (if at all). Growth = spending. No Growth = cost-cutting. This lets you better align your message.

The truth is most companies have 3 key initiatives that are determined by the board and exec team. These initiatives drive all of the decisions throughout the org (and they trickle down to everyone).

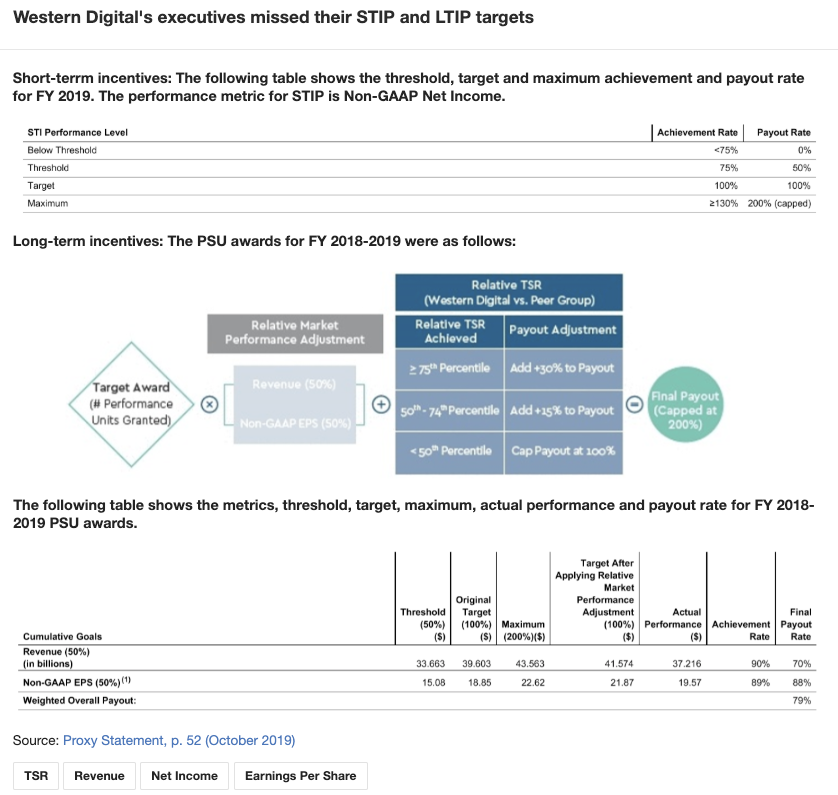

Take a look at this example my friends at Databook gave me from Western Digital. In this snapshot, you can see the comp metrics and performance targets. If you were selling to WDC you can see that 1) 50% of management comp is based on Revenue and 2) 50% on EPS (true bottom line profit per share). Here’s the hyperlink to the proxy statement in case you’ll want to dig in.

So what do you think? How else can you use the DEF 14A to help you sell into your enterprise accounts? Please share your thoughts with me on Twitter: @douglandis.

Enjoying this article?

Sign up to gain access to our thought leadership and have future articles delivered directly to your email.