The enterprise cloud has entered a new era of hyper growth thanks to a combination of dramatically expanded global markets, access to unprecedented later-stage private growth capital and the ability to scale sales organizations with remote talent.

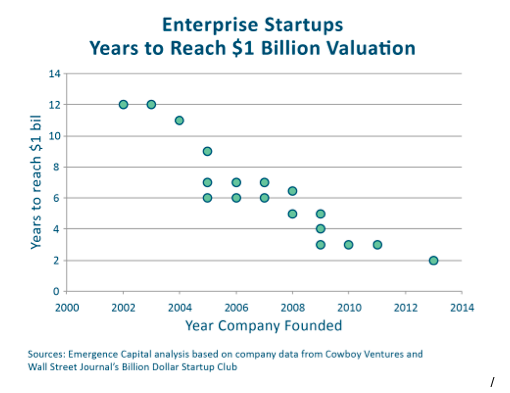

There are more than 25 enterprise cloud companies founded since 2007 that are valued today at more than $1 billion in private markets. As importantly, the speed to $1 billion is accelerating, with several companies founded since 2010 that have reached that milestone in less than three years, something formerly seen only in the consumer Internet.

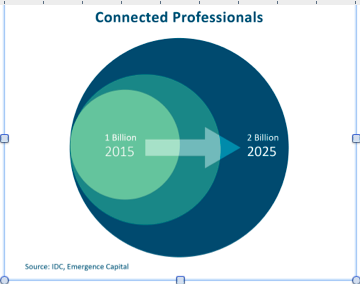

A Billion (More) Connected Global Professionals

Currently there are more than 1 billion Internet and mobile connected professionals in the world, based on recent IDC research. Most of the IT investment of the last 20 to 30 years has been focused on the approximately five hundred million white-collar, desktop workers in developed countries. In the next decade, we will see the number of connected professionals expand to 2 billion or more as access to technology and applications expands dramatically.

The ability for end users to identify and access applications to solve their own productivity needs (the so-called shift to end-user computing) and the opportunity for companies to reach those billions of professionals is unprecedented.

Moreover, companies of every size, in every industry and in every country of the world now have the opportunity to access world-class software applications and information at their fingertips.

Unprecedented Access To Growth Capital

While the cost to start a company and build a product may be at an all time low, the cost to scale and become a leader in the global marketplace is higher than ever. Those without the talent, experience and resources to fight that global war are destined to remain niche players. Those that have the ambition and can amass the talent and resources are now capable of building enterprise companies that will dwarf the leaders of the last generation.

There exists today access to late-stage, private capital at valuations that historically have been available only to the most proven and prolific public companies. That capital availability has changed the nature of the scale-up game, allowing private companies like Zenefits or Slack to raise hundreds of millions of dollars at multi-billion valuations within a couple of years of their founding.

Again, this access to ever-increasing amounts of risk capital — allowing companies to stay private and invest aggressively without the burden of quarterly performance — is unprecedented in the history of the tech business. While most of these hyper-growth startups are consumer-focused and hail from Silicon Valley, an increasing number today are being created across the globe, coming from the enterprise space.

New Sales Talent, Processes And Technologies

The unprecedented size and scope of the market opportunities for cloud and mobile technologies will require a transformation in the philosophy, tools and processes required to succeed in this next era. Part of the magic that is allowing these companies to scale so rapidly are in fact the cloud-based applications and new processes that are enabling sales and marketing organizations to scale globally at unprecedented rates.

More than a decade ago, Salesforce.com pioneered the use of cloud software and a telesales model to enable inside sales to scale an army of sales representatives all over the world. Next, new marketing automation platforms such as ExactTarget (now Salesforce) and Marketo enabled marketers to scale marketing and lead-generation efforts to feed this growing sales army with qualified leads.

The success of companies likeSalesforce.com (our first investment at Emergence) unleashed an explosion of innovation in almost every functional area of the enterprise, but especially in sales and marketing. Cloud-based tools like email marketing, video conferencing, remote presentation software, e-signatures and sales tracking and analytics enabled sales teams to operate from a central location and be highly effective in communicating with prospects and customers.

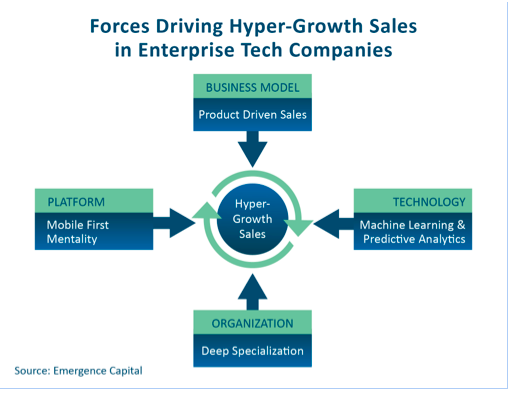

The next generation of winners will take advantage of a combination of critical new innovations. The Era of Hyper Growth, Enterprise Cloud is defined by four fundamental trends:

- Business Model: Product-driven Sales

- Technology: Machine Learning and Predictive Analytics

- Platform: Mobile-first Mentality

- Organization: Deep Specialization

Business Model: Product-Driven Sales

Historically, the vast majority of time and cost consumed in a sales process was spent identifying a prospective customer, educating the prospective customer on your solution, assessing whether they had a pressing need and, finally, convincing them that your product satisfied their need best relative to alternatives in the market.

Today, with the ability for end users to easily search, try and buy applications independently, the amount spent on the front of the sales process has been reduced dramatically. Sales now plays less of a role convincing end users and more of a role in satisfying IT on security, compliance and administrative control and in supporting early customer success and adoption.

In this new product-driven era, finding ways to simplify the value proposition and enable customers to get up and running quickly and easily and reducing any friction involved in the purchase is critical.

New business models were created to help usher in this product-driven sales era, with freemium and free trial most widely adopted. While not all products are simple enough to be easily self-implemented, the ability for the product to drive awareness, trial and usage has become a powerful and compelling competitive advantage for the new era of enterprise products.

While the product-driven sales process has become almost a necessity, to build a global enterprise leader still requires building a world-class outbound sales and marketing engine. The combination of the two is incredibly powerful.

Technology: Machine Learning And Analytics

Historically, analytics have been used to track the activities and results of sales and marketing teams, primarily for the purpose of adding visibility for managers into the sales pipeline. Big data, or predictive analytics, have enabled lots of new insights, but what excites us most are machine learning and true productivity driven analytics — i.e., technologies that can create dramatic efficiencies and leverage for sales reps versus just their managers.

The ability for the cloud to become a true intelligence partner for sales reps means that the two biggest levers of sales productivity — ramp time to productivity and consistent quota attainment — will be dramatically enhanced in the future.

We see a future where sales reps have online training and simulations that dramatically improve their time to productivity. We are also seeing the early evidence of true predictive analytics augmenting real-time decision making in terms of what to do next, whom to contact and how to best approach a prospect based on their individual needs and interests.

Similar to the progress in self-driving cars, what in the past has seemed like incremental progress is about to be broken open with recent advances in machine learning. For example, we have seen companies that are using machine learning applied to voice or online behaviors to dramatically improve the productivity and effectiveness of sales reps.

Companies like Lattice Engine and 4Insight are providing predictive marketing and sales applications that identify who is ready to make a purchase at any given moment. In the not too distant future, we see the advent of wearables like Google Glass combined with machine learning and perhaps remote analytic assistance enabling a real-time army of SuperReps who will be orders of magnitude more productive than the finest sales reps today.

Platform: Mobile-First Mentality

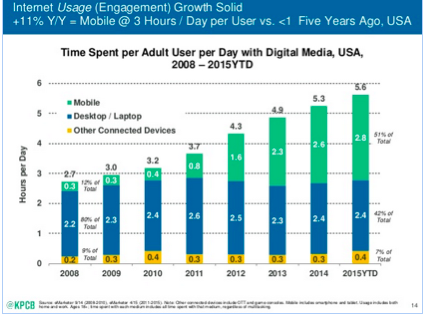

The vast majority of user time is now spent on smartphones versus desktops.

Sales teams of the future are recognizing that increasingly both their workforce and their customers are going to be interacting via mobile phones (versus their desktop). This is requiring a wholesale change in behaviors and tools to react to this fundamental shift.

As difficult as it was for the on-premise enterprise software vendors to make the transition to the cloud, we see a similar challenge with many of the established desktop-centric cloud players making the transition to a mobile-first world. While many have tried, we think the disruptive nature of mobile will enable a new set of players to emerge, and that we are at the very early innings of that transition.

We have invested in companies such as Cotap, Doximity, Handshake and others that are utilizing mobile to deliver on fundamentally new capabilities that can only be done with a mobile-first mentality.

Other companies, such as Clari or Quip, are taking next-generation mobile-first approaches to established sectors like CRM and document creation and collaboration. Sales reps have been early adopters of mobile technologies, given their inherent need to be on the road, and we see much more innovation coming. For instance, geo-targeting may in the future allow one to know where and when someone is near a prospective client and when and how to best reach out to that prospect.

Organization: Deep Specialization

Specialization has always enabled massive productivity enhancements in any process, and the business of sales has now begun to fracture as a result of this movement. Sales “Ops” has become a critical function and expertise that defines the metrics around the entire sales process and puts in place the foundation of tools, systems and processes to enable a hyper-growth sales engine to scale fast without breaking or losing transparency and visibility.

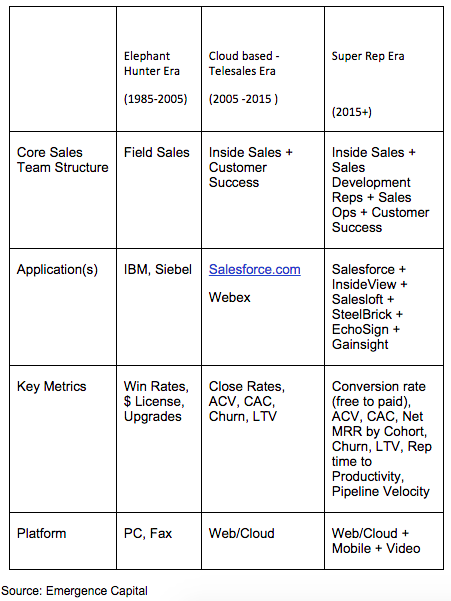

As you’ll see below, the evolution of sales technology can be tracked by evaluating the structure of the sales team, the applications used, the key metrics and relevant platforms.

Many of the recent sales tools have entered the market under the broad umbrella of sales-acceleration technology, or a means to increase velocity over the entire sales process. Estimated to be a $12.8 billion market, the sales-acceleration software market today is roughly where the marketing automation software sector was in 2008 and 2009. We only expect this area to continue to develop as there is a seismic shift throughout the industry.

Some examples of notable new categories of specialization, both for their impact and traction, include:

Sales Prospecting: As organizations have shifted resources to inside sales teams, the sales development rep (SDR) has emerged as a key player in the hyper-specialized sales process. With the SDR now the point person for reviewing and vetting leads, reps now have more time to target higher probability leads. Sales-prospecting tools like Salesloft (in which we have an investment) and Infer have automated much of the manual work involved in prospecting. The specialization of this role and the new tools available to enhance their efforts are perhaps the single most powerful new engine of hyper growth we have seen.

Configure, Price And Quote (CPQ): CPQ software is one of the biggest opportunities of hyper specialization. CPQ functionality allows companies to automate the pricing of products and services according to various economic factors, determine the feasibility of sales strategies like bundling or upselling, then provide customers with optimal pricing. CPQ applications like Apttus and SteelBrick solve a real pain point in the market, producing accurate and professional sales quotes for prospects, thereby increasing sales productivity.

Not only does it enhance rep productivity, but it provides meaningful and real visibility into a sales pipeline that prior to this was a qualitative and error-prone, manual process. The faster you grow, the more you need a CPQ solution; the more you use CPQ, the faster you can grow. This is what we term a virtuous cycle.

Upsells/Customer Success: Companies are placing increasing emphasis on retaining customer relationships. For example, Gainsight, Totango and others provide a 360 degree view of a customer by bringing together information from the CRM, helpdesk, sales and product engagement data silos to show how customers are using a product or service and how that use may be changing over time.

Rise of the SuperRep

All these new technologies, specialization and processes are enabling both the hiring, training and productivity of young, less-experienced sales reps to get up to speed faster, as well as the advent of a new type of “SuperRep” who has both the experience and access to more powerful applications and information that enable them to reach new heights of effectiveness and productivity.

We believe this era of hyper specialization will also bring forth new application providers that create huge value for the enterprise cloud ecosystem, while creating a new set of winners.

.jpg)